When one considers the villains of Christmas, images of a certain Pumpkin King or a sneaky Dr. Seuss character may come to mind. This year, however, the presents under many families’ trees are facing a new threat: inflation.

In the years following the COVID-19 pandemic, inflation rates have skyrocketed. According to the International Monetary Fund, the rate of inflation in 2017 was 3.5 percent. In 2022, it was 8.8 percent– more than a two-fold increase. While inflation has returned to pre-pandemic levels this year, the past year’s spike in costs for nearly every aspect of daily life, from grocery shopping to furniture sales, has changed the spending habits of many students and faculty at STA, especially regarding their holiday purchases.

For senior Fiona Fitzgerald, discovering deals at retail stores, such as Cargo Largo, has become an essential part of shopping for both herself and those she cares about.

“I love the Largo,” Fitzgerald said. “I’ve been there so many times, and I always find something that’s both super cute and insanely affordable. I’ve found items [at Cargo Largo] that, if you look them up online, they’re at least four times the cost. It’s crazy. I’ll definitely be going there a lot during the holiday season.”

Apart from year-round establishments, such as retail or thrift stores, many students were able to participate in Black Friday, the annual U.S. shopping frenzy that occurs on the Friday after Thanksgiving. Brands ranging from Lululemon to Coach offer limited-time sales offers on items, often given on a first-come, first-serve basis.

Senior Charlotte Brettell celebrated this pseudo-holiday while shopping at the Country Club Plaza. Brettell notes that despite the exhilaration of the day, it’s important not to be swept up in the mass-purchasing energy.

“[Black Friday] is super fun, but the influence of so many people around you can be a little [financially] dangerous,” Brettell said. “Going with friends is really helpful, because they can help you decide whether you actually want something or you’re just making a decision out of stress.”

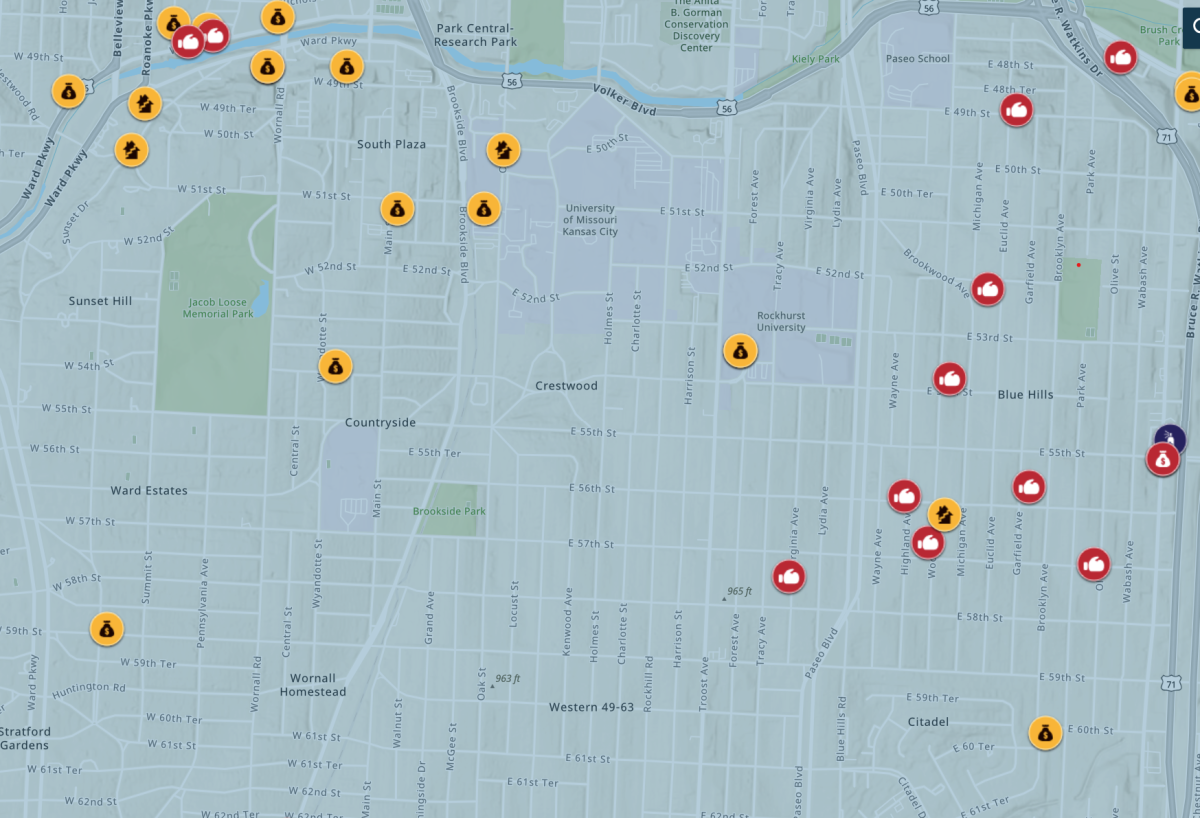

The saga continues, however, into Small Business Saturday. The neighbor to Black Friday, this day is focused on supporting local businesses and shops that may not have the scale to launch campaigns of the same scale as big businesses’ on Black Friday.

Junior Hannah Baker decided to cross off some items for her friends and family while shopping on Saturday. Baker believes local businesses often have more unique and higher-quality goods– two criteria essential to Christmas shopping.

“I love finding handmade items or things that are specific to a store, like the Corner Candle Shop [in Brookside],” Baker said. “They’re making it, they’re crafting those scents– even if you find something similar to it somewhere else, I think that’s really special and people know it.”

Apart from finding deals and steals, both students have changed their whole perception of gift buying in recent years. Brettell has found that setting price limits when buying for friends has unexpected benefits.

“When you can only spend maybe twenty dollars, you have to get more creative. You can make something, you can give something you already own, or you can buy a few small things that really remind you of whoever you’re buying for. When you set a limit, you usually have to gift something more creative and more unique to them”

So will inflation steal Christmas this year? According to students, it’s a resounding “NO.”

Fitzgerald emphasizes that although it’s nice to have extra wiggle room with purchasing gifts, a big budget doesn’t define the Christmas experience.

“As you grow up, I think you realize it really isn’t about the price of your gift, “Fitzgerald said. “Even if you only have five dollars, as long as you put some thought into who you’re buying for, they’ll know you were thinking of them. As cliche as it sounds, it’s the thought that counts.”