When it comes to important events in life, often it’s characterized into firsts: first birthday, first day of school, first car, etc. However, one “first” that surpasses most and is many’s start to adulthood is buying a first home. But when houses are increasing an average median price of 6.3 percent each year, the anticipated moment of buying a house, especially for young couples, may strike many as a challenge.

What was causing this increase in price? That remained a mystery until recently, when a Kansas City group sued the National Association of Realtors and won huge: $1.8 billion to be exact. Lawyer Eric Dirks of the firm William Dirks Dameron answers questions on the who, what, and whys of the case.

“So we did some digging around, and we saw that real estate commissions in the rest of the world were like half, or less, then what they are here [in KC],” Dirks said. “We did some more digging, and we found out that the rule that’s posted by the National Association of Realtors (NAR), says if you want to list your home on a multiple listing service (MLS), you must make an offer of compensation to a buyer broker. So we started digging into that, and we realized that it’s a restraining trade under the federal antitrust statute.”

Once Dirks found the root of the problem, it became clear that it was the violation of one of the federal antitrust statutes that was inflating homes. The next step was to take this to court, but it wasn’t easy.

“The biggest challenge was explaining to the court, to the community, and to the jury that this is not about real estate agents; everybody’s got a real estate agent in their family, or a friend, aunt, uncle, whatever, it’s not about them,” Dirks said. “It’s about the system, it’s about the rules and the corporate people who created these rules.”

Now that the case is won, what does this mean going forward? Dirks explains the projected change on the horizon.

“It’s going to bring the market for real estate agents back to a free, competitive market where folks can actually have a conversation with their agent-whether that’s on the sellers’ side or on the buyers’ side–and negotiate a fair commission,” Dirks said.

Even though a light may be showing at the end of the tunnel for future homebuyers, it’s still difficult to find a house for young adults. When factors such as location, price and design come into play, it makes for a tough search. STA alumna Sophie Cuda, ‘17, discusses her journey with finding a house.

“The biggest difficulty for buying a house has been how high interest rates are,” Cuda said.“Also, how expensive the market is right now, houses are just priced pretty high.”

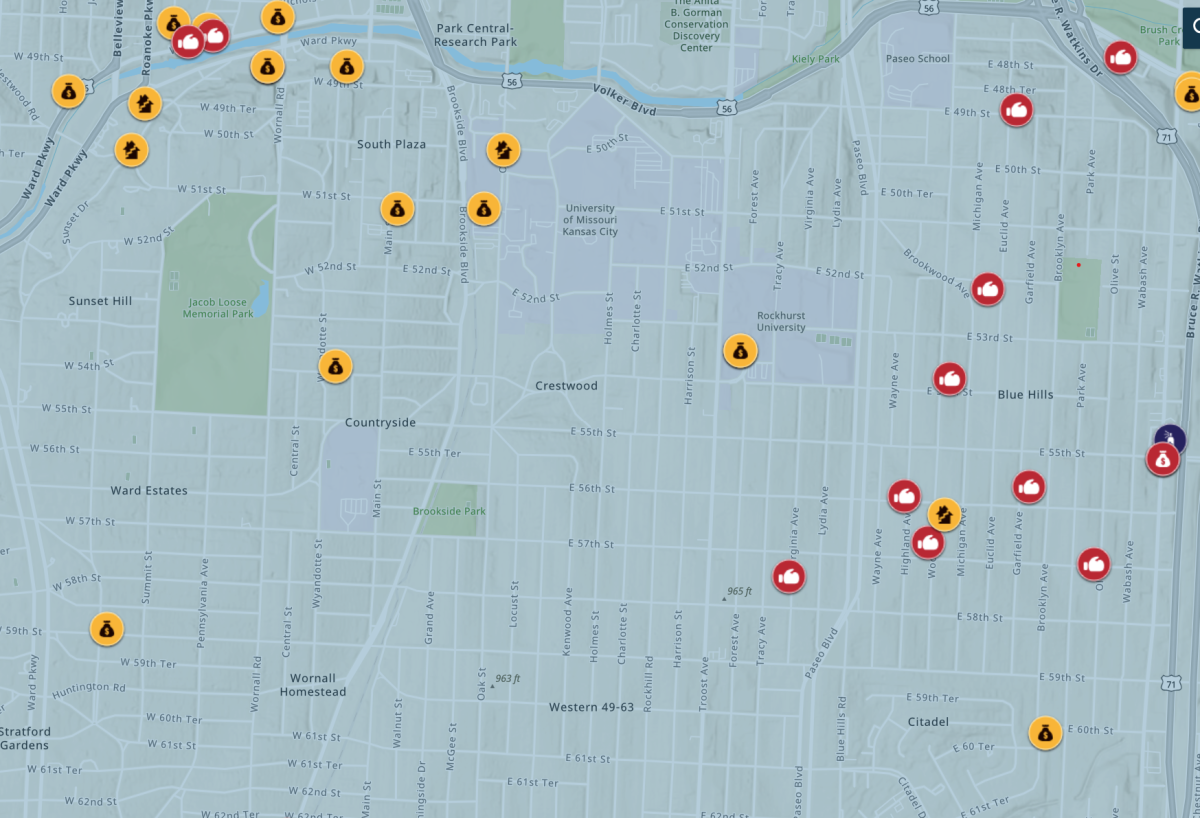

When the buyer’s wants such as location and design come into play, the hunt for a house can become more difficult. In today’s market, Cuda discusses what’s most important for her and what she’s noticed.

“Most important for me is location,” Cuda said. “Since we’ve started searching, prices have stayed the same; I haven’t noticed prices going up or down that much. They’ve just stayed consistently higher than what we’d like.”

Cuda knows that buying a house is no walk the in park. Instead, it’s a bittersweet moment, which, despite the stress, should be cherished.

“My advice for people that are starting to house hunt would be to take it slow, don’t purchase something unless you absolutely love it because it’s a big investment,” Cuda said. “Also have fun; this is an exciting time.”

Whether buyers are looking for a home in Kansas City or California, house prices are skyrocketing everywhere. Even though the Kansas City case made headlines, the future of homebuying still remains unclear, and is no longer an easy “first” for most.